By Bruna Rosso, Daniel Brant, Davi Almeida and Isabella Vallejo, in collaboration with Letícia Aguiar

- Digital transformation in healthcare has the potential to personalize the patient’s experience through an integrated ecosystem and optimize clinical productivity.

- Telemedicine has been a “gateway” for healthcare players and patients into the digital ecosystem.

- Big players can intensify their participation in the digital transformation of health through inorganic disruption, in a scenario where startups catalyze innovation.

The digital transformation of healthcare is a reality that will redefine the way patients are treated and how healthcare providers deliver their services. The reshaping of healthcare from a digital perspective revolves around the personalization of the patient’s experience through an integrated ecosystem capable of conveniently offering customized and precise interventions. It also guarantees healthcare providers optimized clinical productivity and greater precision in care.

One of the most relevant elements in the context of the digital transformation of health is telemedicine¹, which can be understood as primary and specialized care, with a digital prescription, conceptually called teleconsultation. It has been the starting point for major players to adapt to digital health and can improve the patient experience, making it more comfortable and agile, as well as digitizing and centralizing relevant information to feed the integrated digital health ecosystem.

Telemedicine emerged in 1994, but has grown dramatically during the Covid-19 pandemic. Initially, telemedicine healthtechs appeared to meet a still dormant demand for remote care, not tackled by the big healthcare players, who were suffering from a lack of regulation in the sector.

So, during the pandemic, there was a boom in demand: between March and December 2020, there was a drop of 27 million elective medical appointments compared to the same period the previous year, according to the Brazilian Federal Council of Medicine (CFM), while telemedicine grew by around 372% from March 2020 to September 2021 – data from G2 Learning Hub.

This, coupled with the temporary regulations established in Brazil, created a favorable scenario for telemedicine healthtechs, which rode this wave and experienced exponential growth, offering their product mainly to the big players who were not prepared to make this digital channel available.

After this boom and with the relaxation of Covid protocols, telemedicine shows evidence that it will continue to grow. This can be seen in the following factors:

- On June 2nd, 2022, Brazilian Ministerial Order GM/MS No. 1,348 was approved, which provides for Telehealth actions and services within the scope of the Unified Health System (SUS). It recognizes telehealth as a means, attested to by the scientific community, of expanding universal and comprehensive access to health;

- The Brazilian Federal Council of Medicine (CFM) published Resolution 2.314/2022, which defines and regulates telemedicine in the country, as a form of medical services mediated by technology and communication, bringing great legitimacy to the practice. The president of the CFM also said that it is a method with great capacity to bring care to the countryside and reduce the overload in large centers;

- The CFM has made the CFM Digital Certificate available in the cloud, enabling doctors to digitally sign prescriptions for exams, prescriptions and other medical documents, and has created its own digital prescription platform in conjunction with the Brazilian Federal Pharmacy Council (CFF) and the National Institute of Information Technology in Brazil (ITI);

- There are two bills currently before the Federal Senate (PL nº 1998/2020 and PL 4223/2021) which authorize and define the practice of telemedicine in Brazil, establishing, among other measures, the role of health professionals in all states; and

- Studies such as Global Market Insights predict growing financial activity in digital health, with a projected global market size of US$ 426.9 billion by 2027. As far as Brazil is concerned, the study carried out by Statista Global Consumer Survey predicts a market volume of US$ 3.13 billion in 2026.

Given that the future of healthcare lies in telemedicine and digitalization, the big players – hospital groups and health plan operators – are already adapting and need to find ways of leading this transformation. All the evidence and contexts presented demonstrate how digital health and telemedicine can bring development and democratization to healthcare in Brazil and how both are paths of no return.

In order for the transformation to accelerate and for these organizations not to be left behind, one viable path is “inorganic disruption”. In other words, making disruptive innovation practical through acquisitions of healthtechs, as well as the creation of CVC funds or venture buildings, which some players are already doing.

While the potential of the big players is clear, we also see that startups are catalyzing digital health innovation in Brazil.

In this article, we will take a deeper look at this ecosystem and identify how the big players can act to increase their ability to capture value in this scenario.

What telemedicine solutions are available on the Brazilian market and what characterizes them?

To find the opportunities within a market, you first need to understand its segments. Currently², there are three³ main segments of activity in telemedicine: healthcare providers who work exclusively in telemedicine, providers who work in telemedicine and traditional healthcare, and “marketplaces” which act as a connection channel between doctors and patients. We characterized the three segments based on a study of 14 healthtechs with a significant market share and mature solutions.

In these segments, the operating model can vary between B2C and B2B, with the former being the most common and the latter only present in segment 2.

Healthcare providers via telemedicine (non-exclusive), such as popular clinics and hospital groups, only offer solutions directly to the patient, as do marketplaces that offer telemedicine as a channel. In other words, both run within the B2C segment.

Among healthcare providers via telemedicine (exclusive channel), we see that most of the relevant players are healthtechs with a business model focused on B2C through individual consultations or health programs (competing with popular health plans) and on B2B by offering outsourced healthcare services to insurers and health plans.

What services and functionalities do healthtechs offer?

Based on the 14 healthtechs analyzed in the characterization of the segments, we mapped the services and functionalities offered in the market to identify how the players can differentiate themselves.

In terms of the services offered, the players with chronic follow-up and a wide range of specialists stand out. The focus of the players is largely on consultations with general practitioners, without the need for specialists. Players that offer remote chronic follow-up services via the platforms – treatment that would require patients to spend a lot of time traveling in person – and those that offer a wide range of specialists stand out.

Emergency room: immediate care, through triage, and available 24/7 with a general practitioner.

Primary care: appointment with a general practitioner.

Specialized care: care scheduled with a specialist and defined.

Chronic follow-up program: periodic medical follow-up protocol via telemedicine or message.

Psychological follow-up / psychotherapy: scheduled appointments with psychologists or psychotherapists.

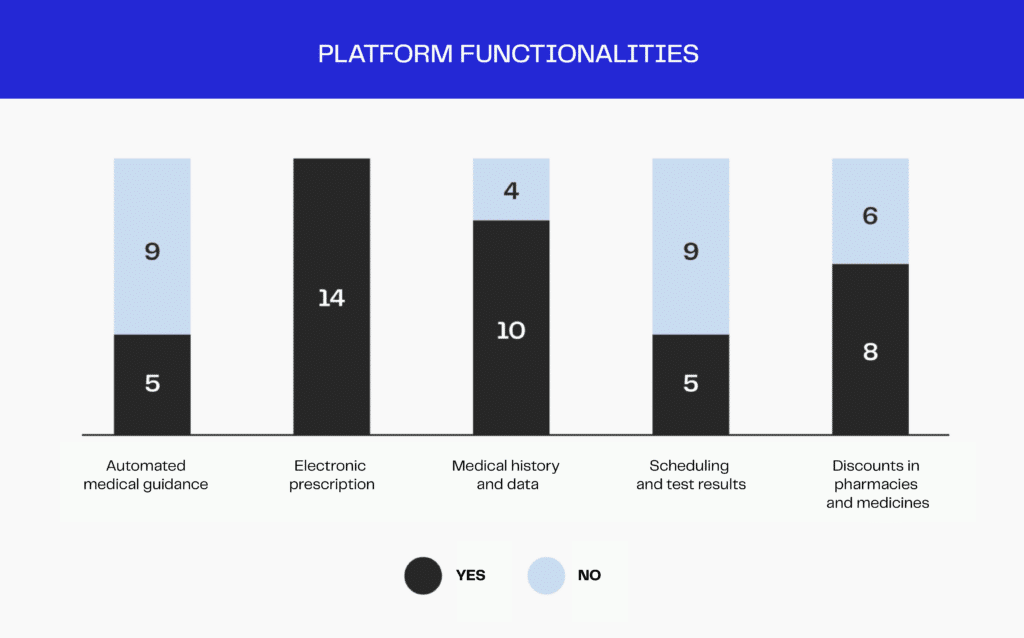

In terms of the functionalities offered, there is a difference between the players with automated medical guidance and scheduling and test results. Electronic prescriptions are a widespread feature among healthtechs. On the other hand, the least common functionalities are automated medical guidance and scheduling and test results. In other words, human work is still poorly optimized by artificial intelligence and telemedicine solutions are poorly integrated with clinics where tests are carried out.

Automated medical guidance: pre-diagnosis artificial intelligence with redirection of the patient to face-to-face or remote care.

Electronic prescription: the generation, transmission and electronic filling of a prescription based on medical software. Today, this functionality is seen as a must-have for platforms.

Medical history and data: the digital medical record with a history of exams, consultations and procedures integrated with remote monitoring is clearly a differentiator and offered by most platforms.

Scheduling and test results: few players offer integration with laboratories and make tests available within the platform.

Pharmacy and medicine discounts: connection to pharmacy marketplaces and discount offers are features present in most players.

How have the big hospitals and health insurance companies been acting in telemedicine?

All the major hospitals and health insurance companies have adapted to telemedicine. But the first group still has solutions that lag in maturity and innovation compared to the rest of the market.

Large hospitals

We studied 10 of the largest and best-rated hospitals in Brazil: Hospital Israelita Albert Einstein, Hospital Sírio-Libanês, Rede Materdei de Saúde, Beneficiência Portuguesa, Rede D’Or, Dasa, Hospital Alemão Oswaldo Cruz, Hospital Moinhos de Vento, Hospital Santa Catarina and Hospital Mãe de Deus.

All these hospitals have adapted in some way to telemedicine, allowing at least teleconsultations for emergency care or general practice. However, it was seen that, in general, the telemedicine platforms used by the large hospitals are outdated in terms of maturity and usability compared to the healthtechs considered in the study.

In addition, all the hospitals have their own telemedicine solution and may outsource the video call platform.

Health insurance providers

We analyzed 6 health insurance companies with great national relevance: Bradesco Saúde, Hapvida, Amil, Unimed, Notredame and SulAmérica.

Like the large hospitals, all the health insurance companies have their own telemedicine solutions. However, compared to the large hospitals, the operators’ digital solutions are more mature and have better usability. After all, while almost all the hospitals mentioned use online portals, most of this group of operators have their own app.

Why is telemedicine just one channel within digital health?

Although there are good opportunities in telemedicine, the digital health ecosystem goes far beyond it, so players’ activities should not be limited to this channel. The digital health ecosystem is very broad and comprises several different channels, platforms and technologies that work to add value to the patient. See the table below.

Yet, telemedicine is a good entry point for patients and players in digital health. As mentioned earlier, digital health players have telemedicine as their entry point, as it is one of the most widespread and easiest ways to adapt to this digital landscape. Similarly, for the patient, teleconsultations tend to be very convenient and timely. After all, a face-to-face consultation can be more difficult to schedule and travel requires more effort, cost and time, especially for residents of rural areas or people with disabilities.

Based on this latent demand, healthcare providers can take advantage of the patient’s first contact with digital health through telemedicine and use instruments to keep them, such as remote monitoring, engagement mechanisms or other options presented above.

However, players entering this ecosystem must pay attention to one point: integration involves a large volume of sensitive data. One of the main goals of the digital health ecosystem is to promote the integration of information and services, making life easier for patients and perfecting the performance of healthcare providers. For integration to take place, sensitive data must be handled, so those who manage this data must comply with the Brazilian General Data Protection Act (LGPD) to respect the law and patients.

How can healthcare players capitalize on digital health, starting with telemedicine?

We have seen that the big players in healthcare have already started their work in telemedicine, but we know that there are still unexplored opportunities in the area. The adaptation of traditional healthcare providers to telemedicine, as presented, is still lagging other solutions on the market. We also showed that there are different services and functionalities that can be offered within telemedicine. Players therefore have the following options for exploring the area:

- Improve services, functionalities and technologies internally to make the patient experience as complete as possible, standing out from competitors;

- Develop new technologies in-house through venture-building and spin-offs (at the risk of not being agile enough); and

- Create innovation environments to develop disruptive solutions through partnerships, funding (CVC) or even M&A.

Finally, healthcare providers wishing to spearhead the digital transformation of healthcare in Brazil must explore the various facets of the ecosystem. We understand that the digital transformation of healthcare is driven by the various benefits it generates for patients, such as convenience and better access, and for healthcare providers, such as reducing infrastructure costs and optimizing work. However, the greatest benefit and goal of this transformation is the integration of the healthcare ecosystem.

Connecting the different forms of health care not only provides greater comfort for those involved, but also ensures that this care is as complete and assertive as possible. Therefore, exploring the breadth of the digital health transformation ecosystem is not just a way for players to stand out in the market, but the solution to the most important purpose of their business: taking the best care of people’s health.

¹The term “telemedicine” takes on different connotations depending on the entity or body that uses it, but most definitions refer to a broad concept, analogous to digital health. According to the CFM, telemedicine is “the practice of medicine mediated by Digital, Information and Communication Technologies (DICTs), for the purposes of care, education, research, disease and injury prevention, management and health promotion”.

²Study carried out in 2022.

³There is a fourth segment of telemedicine technology for clinics, hospitals, independent doctors and health plans, in addition to CRM and clinical/hospital management, which is outside the scope of the study.

BRUNA ROSSO works as Senior Manager at EloGroup.

DANIEL BRANT works as Manager at EloGroup.

DAVI ALMEIDA works as Executive Director at EloGroup.

ISABELLA VALLEJO works as Director at EloGroup.

LETÍCIA AGUIAR works as Intern at EloGroup.