By Thiago Fukamati, Alvaro Oliveira, Caio Moura, Victor Chitarra and Leticia Aguiar

- The article discusses the production of biomethane from sugarcane waste in Brazil, highlighting its potential to replace natural gas and decarbonize industrial sectors.

- The study assesses the economic and financial viability of three biomethane plants, taking into account factors like the sale price, CBIOs (Decarbonization Credits) and operating costs.

- The article concludes that for biomethane to play a relevant role in industrial decarbonization, it is necessary to overcome logistical challenges and rely on consistent public policies and economic incentives.

Biogas is a gas composed mainly of methane and carbon dioxide, obtained from the biological decomposition of organic waste. Its composition varies from 60 to 65% methane (CH4), 35 to 40% carbon dioxide (CO2) and other minor constituents, according to Schultz and Soares (2014). From the purification of biogas, biomethane is obtained, a biofuel gas composed of at least 90% methane (CH3), according to the Brazilian National Agency of Petroleum, Natural Gas and Biofuels (ANP) (2022), which makes biomethane a direct substitute for natural gas.

Biomethane can be produced from different sources of organic matter, such as urban waste, animal waste and agroforestry waste. Among the potential raw materials, sugar cane waste has the second highest production potential and market value.

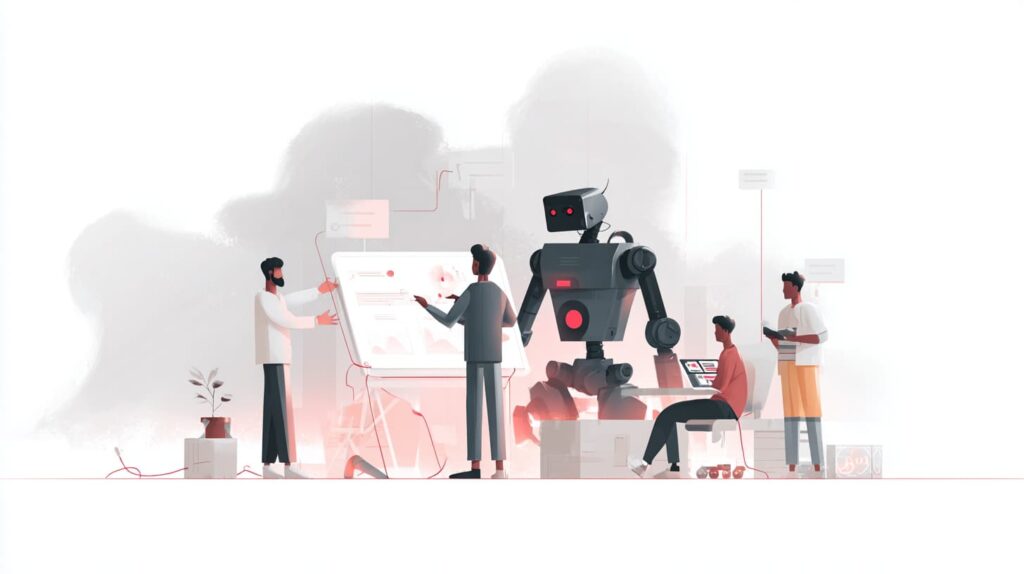

The production of biomethane from sugar-alcohol waste is based on filter cake, a solid residue resulting from the filtration of sugarcane juice in the sugar and ethanol production process, as well as vinasse, a by-product of ethanol distillation. The filter cake and vinasse go through the processes of anaerobic decomposition, desulphurization and moisture removal to increase the concentration of methane, resulting in biogas. The biogas, in turn, goes through the purification process, which consists of removing a large part of the carbon dioxide (CO2), producing biomethane, as described in Schultz and Soares (2014). Figure 1 illustrates the raw materials, products and by-products of the sequence described and highlights how biomethane can also be used as a reagent in the synthesis of ammonia.

Figure 1 – Production chain for biomethane produced from sugarcane and its use in ammonia production

Source: EloGroup

Because of its production process, biomethane is a biofuel with a removal capacity of 73.96 tonCO2eq for each megajoule used (CIBiogás, 2023), eligible for certification under RenovaBio, the National Biofuels Policy instituted by Law No. 13,576/2017, with the aim of reducing the carbon intensity (CI) of the Brazilian transport matrix. RenovaBio establishes that for every tonne of CO2 equivalent mitigated for certified biofuel producers, a Decarbonization Credit (CBIO) is issued, a financial asset that can be traded on the stock exchange and sold by the biomethane producer to raise additional revenue for the industry. CBIOs are an important source of income for biomethane producers, making it possible to build and operate production plants.

Brazil's potential and the importance of producing biomethane from sugarcane waste

Brazil has the capacity to be one of the largest biomethane producers in the world, tied with China and second only to the United States and Europe, according to a study by the BNDES (2024). In 2023 the country had 6 plants authorized by the ANP, producing a total of 417,000 m³/day. This production is expected to double by the end of 2024, with the planned approval of 11 new plants and a production potential of 761,900 m³/day, according to a study by CIBiogás (2023).

If Brazil reaches the potential for producing biomethane from sugarcane, it will be possible to decarbonize approximately 23 trillion tonCO2eq / year from 2040. However, for this to be possible, sugar and ethanol companies’ investment in biomethane must be technically and economically viable in the short and long term.

The internal rate of return (IRR) analysis makes it possible to assess the viability of biomethane plants, and the analysis of its levers can be used as a guide to draw up measures to attract investment to the sector. Assessing the impact on consumer sectors such as ammonia also provides relevant insights for measures to attract new biomethane consumer markets.

Objectives

The main objective of this article is to evaluate the internal rate of return (IRR) for 3 sugar and ethanol biomethane plants and the effect of changes in sales price, CBIO price and Opex on the rate of return. As a secondary objective, the study evaluates the financial impact of using biomethane in ammonia production. Based on the results found, measures are suggested to attract greater investment to the sector.

Methods

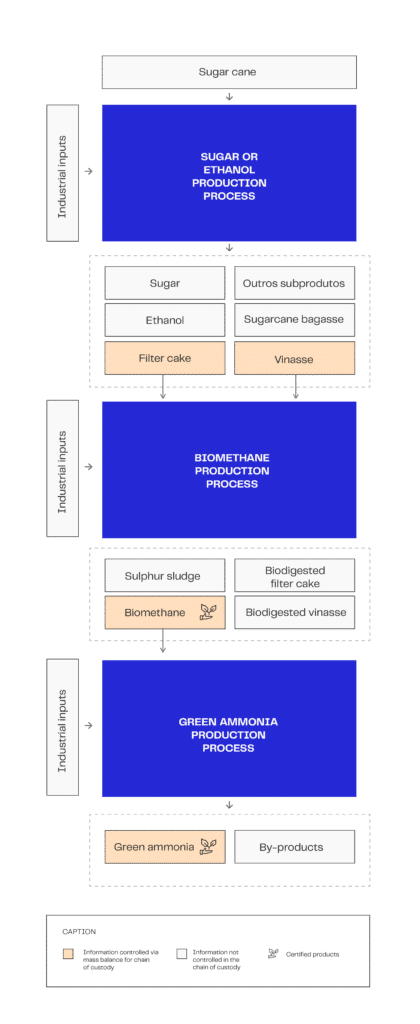

A technical and economic feasibility analysis of 3 cases was carried out using publicly available data for plants with production capacities of 26.0, 21.9 and 15.6 mm m³ / year, and Capex of R$ 325.8, 222.4 and 255.9 mm, hereinafter referred to as Cases 1, 2 and 3. The investment and biomethane production capacity of each plant was collected from the companies’ public communications, and adjusted according to the IPCA index for values in February 2024. The assumptions used for the economic analysis are set out in Table 1.

Table 1 – Summary of assumptions

Source: EloGroup (authors)

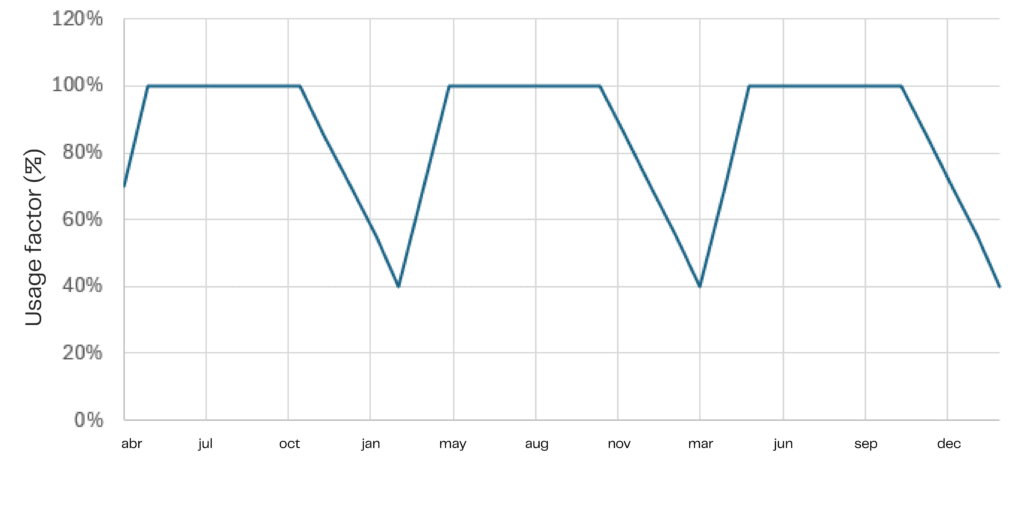

The production capacity utilization factor is a monthly average of biomethane production considering the availability of raw materials in the off-season, which takes place between December and April for sugarcane, as can be seen in Companhia Nacional de Abastecimento (CONAB) (2017). The filter cake is stored to maintain biomethane production throughout the year, and cannot reach critical production limits due to the cost involved in replacing the microbiological environment when the operation stops. It was considered that production does not exceed the lower limit of 40% of production capacity, being reduced linearly until the start of the harvest in April, from which point it reaches a maximum of 100% utilization, providing an average of 85% throughout the year, as shown in Graphic 2.

Graphic 2 – Utilization factor variation according to harvest month

Source: EloGroup (authors)

Opex is based on a reference from the Energy Research Company (EPE) (2023) which considers the operating costs of a sugar-alcohol biomethane plant to be R$0.123, adjusted according to the IPCA. Operating expenses were disregarded, since the cases analyzed are large companies where the biomethane plant would make up less than 1% of turnover, and the company’s current structure could absorb the biomethane demands.

The construction time of 2 years, operating period of 20 years and depreciation of 5% per year takes into account other similar studies for biomethane plants, such as EPE (2018) and Rocha and Soares (2021). An equity investment structure was considered for cases 1 and 2, and 50% equity investment for case 3, with the remaining 50% through BNDES financing according to the FINEM line for Gas and Biofuel Distribution, considering an interest rate of 6.2% p.a. and a term of 8 years, as carried out in the analysis of biomethane plant financing by EPE (2018). All 3 cases were considered real profit given the turnover of the companies analyzed.

Biomethane’s greenhouse gas (GHG) reduction of 73.96 gCO2eq / MJ takes into account RenovaBio’s energy-environmental efficiency score for sugar-alcohol waste plants, as described by CIBiogás (2023). The CBIO reference value used was the 2024 average (up to March 2024), as provided by NovaCana (2024).

Results

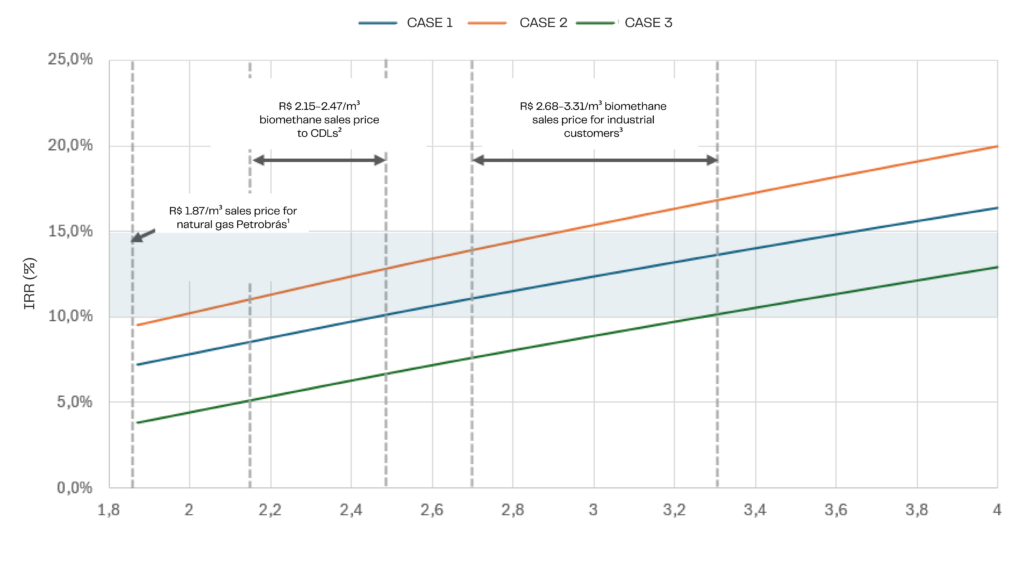

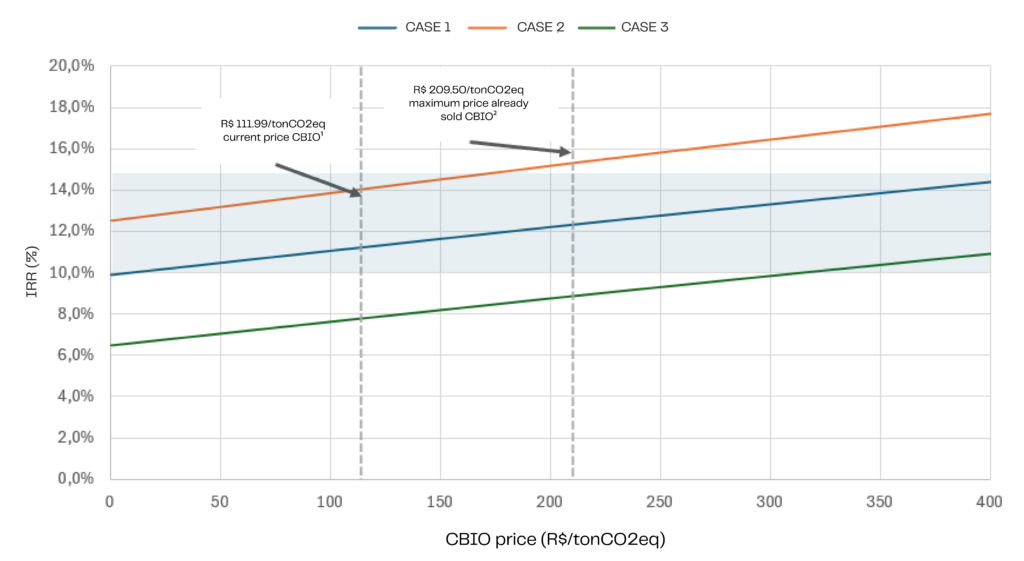

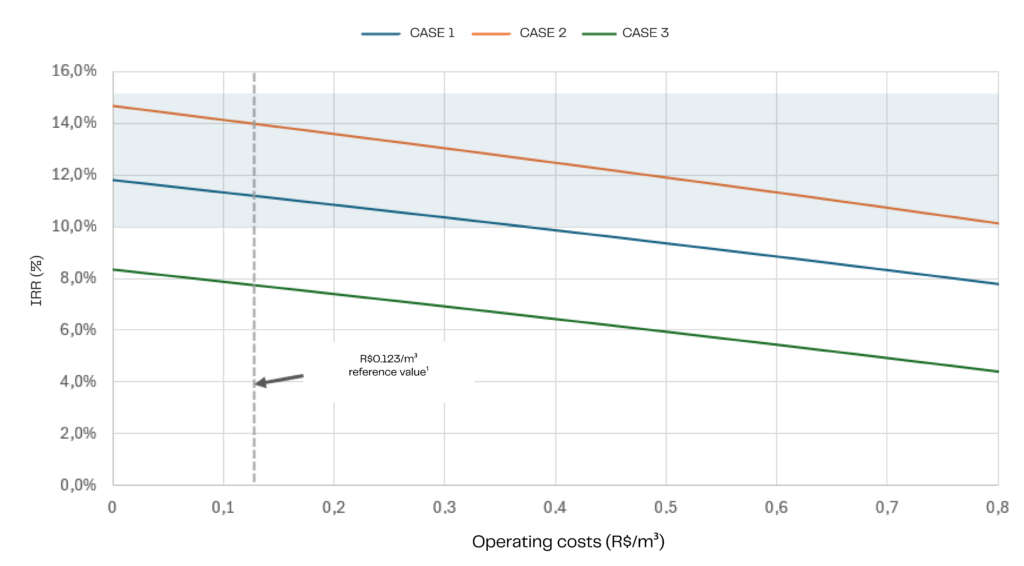

The sensitivity analyses of the IRR according to variations in the price of biomethane, the price of CBIOs and costs are shown in Graphics 3, 4 and 5, with emphasis on the graphics for market reference values. Also highlighted is the IRR range of 10-15%, a value used to compare with the Minimum Attractiveness Rate or the Weighted Average Cost of Capital when private institutions make their investment decisions and which has also been used in other similar studies to analyze biomethane plants, such as EPE (2018) and Rocha and Soares (2021).

Graphic 3 – Sensitivity analysis IRR and biomethane price

Source: EloGroup (authors). 1. natural gas sales price of R$2.05/m3 from Petrobrás to CDLs, converted to biomethane PCS; 2. according to the price index for CDLs by Argus (2024), disregarding the influence of CBIOs; 3. according to the study published by Rocha and Soares (2021), adjusted for the IPCA.

The interpretation of the return analysis depends on the commercial context of each case analyzed. Industrial customers tend to pay higher premiums for biomethane because of their industry’s voluntary decarbonization targets, and should therefore be defined as a commercial priority for biomethane plants that want a higher return. The prices charged to industrial customers make most investments in biomethane plants viable, but they could be higher to make structures that require more intense Capex viable.

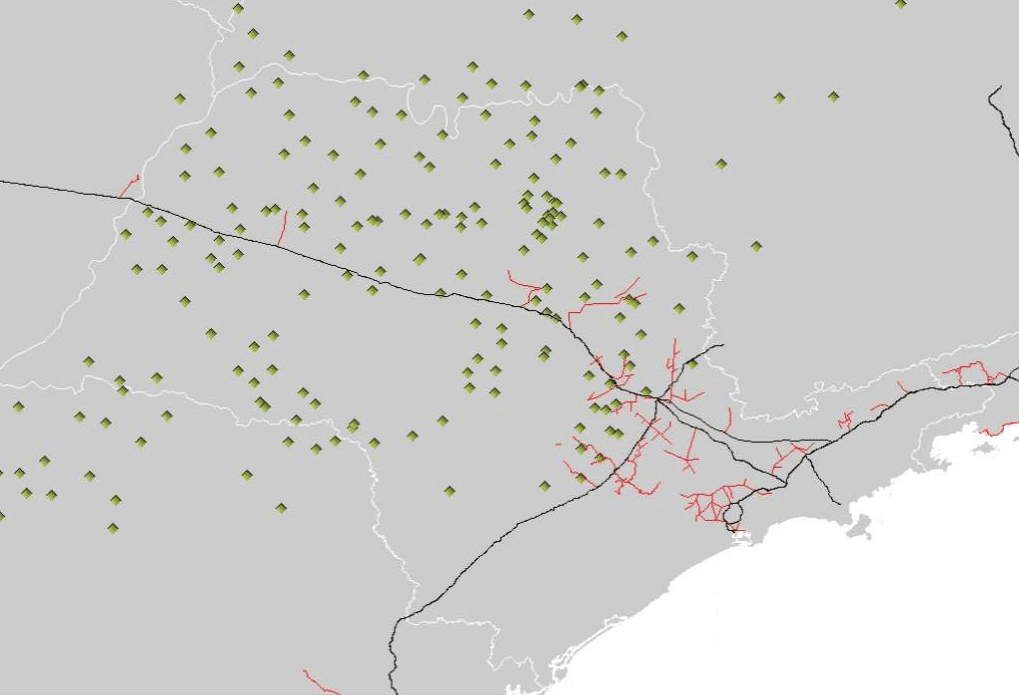

The investment required is also a critical factor in determining the economic viability of the biomethane plant. The plant in case 3 has external financing and a Capex per production ratio of R$ 21.9 / m³, compared to cases 1 and 2, with R$ 16.7 and 13.5 / m³, respectively, which generates lower internal rates of return. One of the main factors that may influence the need for additional investment is the Capex required to make the flow of biomethane production viable. Most of the sugar and ethanol plants are far from the distribution and transportation networks, as shown on the map in Figure 2. As analyzed by the Brazil Energy Program (BEP) (2022), investment in extending gas pipelines to connect to the plant, small-scale distribution with compression (as considered in case 2) or biomethane liquefaction must be evaluated for each economic feasibility study individually.

Figure 2 – Distribution map of sugar and alcohol plants and gas distribution and transportation networks

Source: CIBiogás (2023).

As the industry, which is currently in its infancy, develops, investments in the structure of sugar and ethanol biomethane plants tend to decrease and new means of financing with lower interest rates tend to become more accessible. The sector currently has adequate funding for large-scale biogas and biomethane projects, according to a survey carried out by the BNDES (2022). Financing sources include the New Development Bank (NDB), the World Bank, the Inter-American Development Bank (IDB) Invest, Proparco, the BNDES and the Far South Regional Development Bank (BRDE).

Graphic 4 – Sensitivity analysis IRR and price of CBIOs

Source: Prepared by EloGroup (authors), considering a fixed biomethane sales price of R$2.73/m³, based on the average between the Argus index (2024) and Rocha and Soares (2021). 1) The CBIO reference value used was the 2024 average (up to March/24), as provided by NovaCana (2024). 2. maximum price of CBIOs according to Fava (2023).

The analysis of CBIO prices demonstrates the importance of government incentives for biofuels. In a scenario without RenovaBio, investments in sugar-alcohol biomethane plants become mostly unviable. However, there is still potential for improvement if CBIOs return to the prices reached in June 2022 of R$209.50, which fell after Decree No. 11,141/2022, which postponed the deadline for fuel distributors to prove their decarbonization targets from 2022 to September 2023. For this to be possible, the government needs to meet the targets set to provide a positive growth outlook for the biomethane industry in Brazil.

There are other government projects that could encourage the production of biomethane, as compiled by BNDES (2022), such as Bill 3.865, of 2021, with the proposal to create the Incentive Program for the Production and Use of Biogas, Biomethane and Associated Co-products (Pibb), Bill 2. 122, of 2021, with a proposal to establish a regulatory framework for financial assets associated with the mitigation of greenhouse gas emissions, and Bill 1.879, of 2022, with a proposal to create a Policy for the Production and Use of Biogas and Biomethane, and Bill 412, of 2022, with a proposal to create emissions quotas and new financial assets. However, the regulations still need to be consolidated to make biomethane production viable in the sector.

Graphic 5 – IRR and Opex sensitivity analysis

Source: Prepared by EloGroup (authors), considering a fixed biomethane sales price of R$2.73/m³ according to the average between the Argus index (2024) and Rocha and Soares (2021). 1. according to the EPE Opex reference value (2023).

Opex is a fourth critical factor that must be assessed when analyzing the viability of biomethane plants. The reference of R$ 0.123/m³ is based on public data sources and does not take into account the particularities of each plant, which depends on the Capex invested, production capacity, industrial automation, inputs, maintenance and various factors that were not considered in isolation.

Assessment of costs and environmental impact in ammonia production

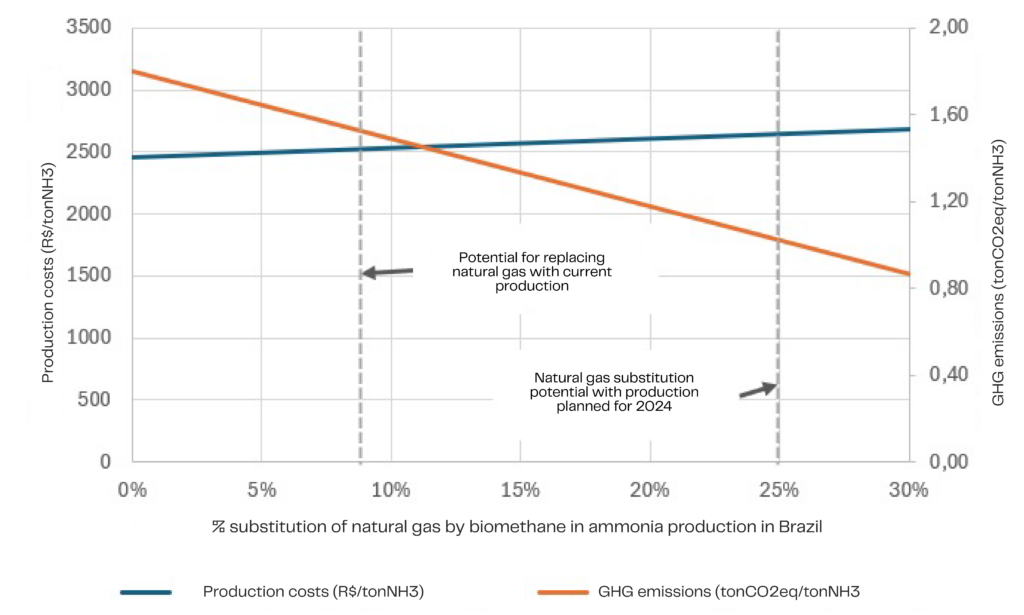

Biomethane plays an important role in decarbonizing sectors that use natural gas in their production processes. In the case of ammonia, biomethane can be used to replace natural gas without the need to alter industrial processes, reducing GHG emissions. Ammonia from biomethane is not yet produced in Brazil, despite contracts being signed for its supply, and therefore a price analysis is not possible. However, the analysis of costs and GHG emissions provides a basis for indicating the viability of its use in industry.

As assessed in Graphic 6, biomethane has the potential to replace approximately 25% of natural gas in the sector by 2024, with the potential to decarbonize approximately 43% of the industry’s GHG emissions and increase production costs by only approximately 8%. As biomethane has a CI approximately 20 gCO2eq/MJ lower than natural gas, emissions from ammonia production could reach 0 before natural gas is completely replaced by biomethane. The impact on costs is marginal, and its effect could potentially be offset in the sale price of ammonia. The preliminary analysis shows the potential of biomethane to decarbonize one of the sectors that uses it in its production process. However, the sector still has a long way to mature before it reaches its potential, given that current biomethane supply contracts replace less than 1% of natural gas in ammonia production in Brazil, according to Yara (2021).

Graphic 6 – Analysis of costs and GHG reductions when replacing natural gas with biomethane in the ammonia production process

Source: Elogroup (authors), with production costs from EPE (2019), GHG emissions from ammonia from IEA (2021), national ammonia production from Petrobrás (2009) and national biomethane production from CIBiogás (2023).

Final considerations

The biomethane market is still in its early stages, and future projections of growth in supply and demand for biomethane in Brazil are a key factor in the long-term viability of projects. The attractiveness of the industrial sector for biomethane producers can be seen in the prices charged, reflecting companies’ interest in meeting voluntary decarbonization targets. Companies such as Yara, Scania, Volkswagen, L’Oreal and Ambev have publicly announced the purchase of biomethane for internal use in fleets or industrial processes. As environmental goals become more relevant and the industrial market for biomethane consumers consolidates, it is expected that more attractive prices will be charged to meet demand, making the production of sugar and ethanol biomethane more viable.

Government support is fundamental to the viability of biomethane projects, and RenovaBio is an important incentive for its production, without which projects would be economically unviable. However, maintaining the government’s commitment to decarbonization targets is essential if RenovaBio is to prove to be an effective program in the long term, providing the stability needed to make investments in the sector a reality.

The logistical challenges of transporting and distributing biomethane still need to be overcome, given the position of sugar and ethanol plants in relation to the natural gas distribution network. Investments in gas compression and liquefaction, as well as expansion of the existing network must be considered when evaluating biomethane plants, and are a limiting factor for the development of the sector. Current sources of investment are adequate for the sustainable growth of the industry, providing the necessary support for the expansion of biomethane plants.

Biomethane will play a strong role in decarbonizing industry in Brazil over the coming decades. In order to make current projects viable and meet future decarbonization demands, the production of biomethane from sugar cane needs to be consolidated in the country, using the support of consolidated public policies over the next few years, available resources for financing, overcoming the logistical challenges of transport and distribution, as well as the greater maturity of the biomethane consumer market for voluntary decarbonization.

THIAGO FUKAMATI works as partner and executive director at EloGroup.

ALVARO OLIVEIRA works as senior manager at EloGroup.

CAIO MOURA works as manager at EloGroup.

VICTOR CHITARRA works as case leader at EloGroup.

LETICIA AGUIAR works as analyst at EloGroup.