By EloInsights

- Report highlights a shift in focus in CVC units towards generating new business, with more immediate results.

- Research reveals that the management of CVC units is often reported to CEOs and CIOs, reinforcing the strategic importance of these initiatives.

- The document also points to a need to promote gender diversity within CVC teams in Brazil.

In recent years, Corporate Venture Capital (CVC) has gained ground in Brazil as an instrument adopted by large companies to connect with the entrepreneurial ecosystem, access innovative technologies and business models, incorporate talent and diversify to their portfolio. In the country, CVC has been consolidated as a key tool for corporations wishing to position themselves at the forefront of technological and business innovation, in addition to obtaining significant financial returns.

It is in this context that the Brazilian Private Equity and Venture Capital Association (ABVCAP) is launching the 2023 edition of its research on the national Corporate Venture Capital market, produced together with EloGroup plus Fundação Dom Cabral, ApexBrasil, Global Corporate Venturing (GCV) and Vivo Ventures/Wayra.

The year 2023 was challenging for the Venture Capital sector, directly affecting CVC activities. Only five new CVC funds were created in the country, showing a downturn in investments. This scenario highlights the need for agile adaptation to market dynamics and the search for more resilient investment approaches.

“The ABVCAP report is very important for providing companies with a benchmark against which they can compare themselves,” explains Jaime Frenkel, partner and executive director of EloGroup. “Both for companies that have not yet joined the CVC and are evaluating the market situation to decide if it is the right time to join, and for companies that are already involved and want to compare their practices with those of their peers. The report analyzes various aspects, such as the time it takes to complete deals, the size of teams, remuneration practices, etc.”.

“This study reflects the recent trends we have observed in the innovation ecosystem in 2023, highlighting a relative slowdown,” points out Frenkel. “The years 2021 and 2022 were marked by a strong acceleration in investments, with very high valuations, often higher than what were considered fair values. We are currently seeing a slowdown at this pace. This change indicates a reduction in the availability of capital; however, for investors who have resources and can invest, this is a favorable time, as valuations are lower, and companies have greater capacity to carry out advantageous and strategic deals”.

What is new this year is that the survey has been expanded, integrating it with the GCV [Global Corporate Venturing] database. This has made it possible to obtain more in-depth and comparative insights into global practices. This year’s survey covered various aspects such as investment vehicles, governance, investment theses, business development, return on investment, evaluation metrics, among others, reaching a response rate of 48% of CVCs active in Brazil.

This article presents some of the report’s main findings.

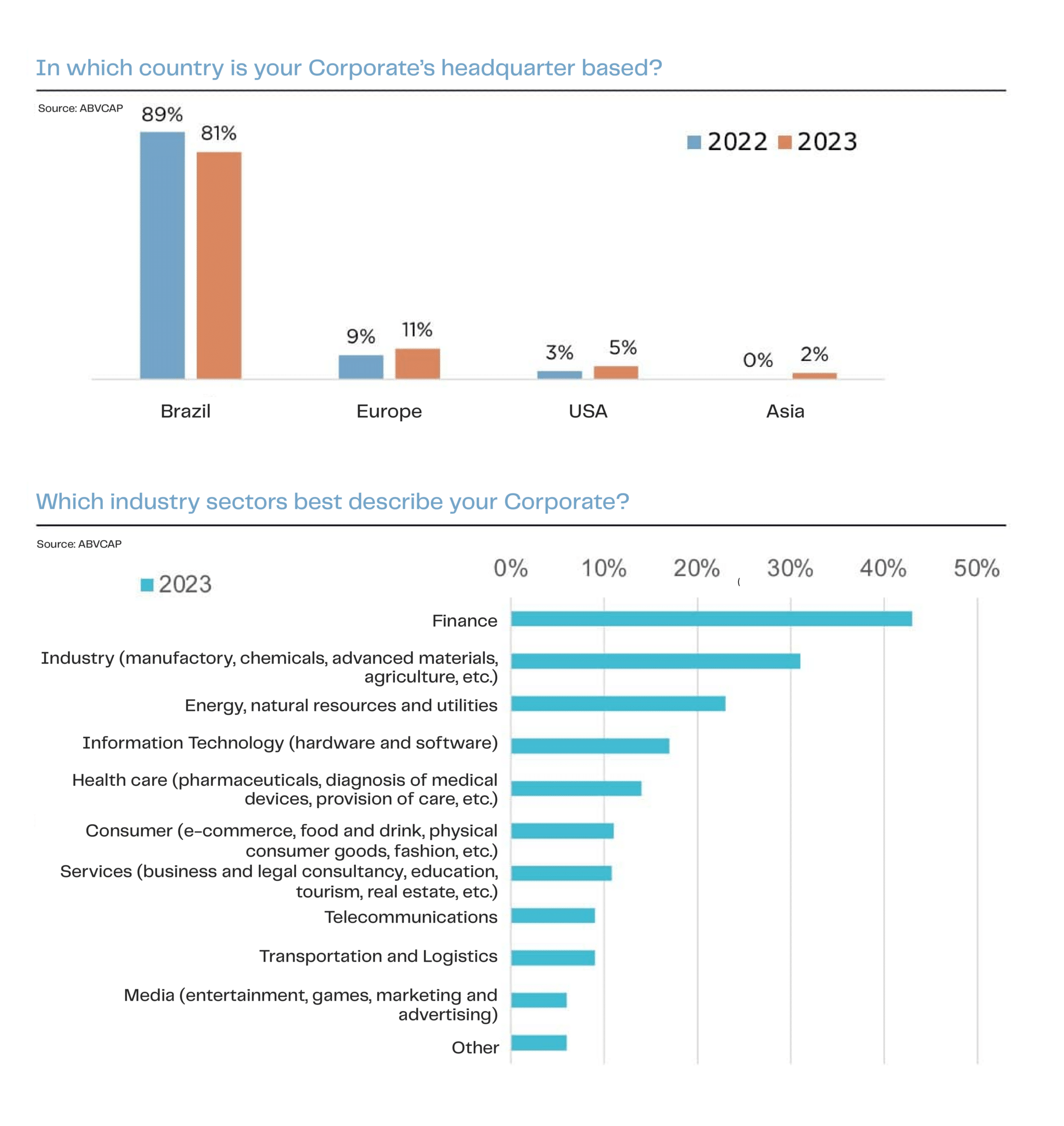

Geographical and sectoral profile of CVCs

The survey shows a wide variety of industries involved in CVCs. Financial services lead the way, with 43% of companies participating. Manufacturing, with 31% of responses, and the energy sector, with 23%, also show significant CVC activity. Only 6% of the responding companies operate in the media segment.

In terms of geography, 81% of the companies have their headquarters in Brazil, consolidating the strong national presence among the respondents. The remaining companies are predominantly multinational, with headquarters in the United States, Asia and Europe, reflecting a growing interest from American investors and a modest advance by Asian companies.

Perceptions of business conditions

The assessment of business conditions by companies involved in Corporate Venture Capital in Brazil tends towards optimism. Around 42% of the participating companies classify current conditions as neutral, with scores between 6 and 7.

On the other hand, only 11% of the companies have a negative view of the market, giving scores between 4 and 5. At the other end of the spectrum, a significant 48% of companies are strongly optimistic, with scores between 8 and 10. This positive perception is in line with general economic resilience and could be an indication of confidence in opening and expanding new CVC units in the country.

Changing priorities

In 2023, a significant change marked the priorities in Corporate Venture Capital programs in Brazil. “Generating new business” emerged as the top priority, replacing “Preparing for future disruption”, which had dominated the previous year. This realignment reflects a strategy more oriented towards immediate and sustainable results, indicating a shift in the focus of CVC companies towards a more active approach to generating value.

The same way, there was an increase in the importance attributed to financial return objectives and to supporting existing businesses, which suggests an evolution in the strategy of investing companies, which now seek not only to protect themselves against future uncertainties, but also to maximize the potential of their current investments.

Accountability dynamics

In the governance structure within Corporate Venture Capital units in Brazil, the trend is towards direct reporting to the top executive leadership. In 2023, most CVC units (55%) reported to the CEO (Chief Executive Officer), while 24% were under the supervision of the CIO (Chief Innovation Officer), consolidating the central role of these leaders in the management and strategic orientation of CVC activities.

The representation of CFOs (Chief Financial Officers) also increased significantly, from 8% in 2022 to 21% in 2023. This finding coincides with the trend already revealed in the previous point, that CVC strategies have been more aligned with the financial outlook of corporations.

Challenges in promoting diversity

The gender composition of Brazilian CVC teams has a male predominance, a pattern that not only persists but also has intensified in 2023. Last year, 67% of CVC units reported a male majority in their teams, an increase from the 57.3% observed in 2022. Only 25% of respondents indicated a more balanced distribution between men and women in their teams.

This is, therefore, a point of attention. Diversity is crucial for organizational performance and effectiveness. Diverse teams bring a wider range of perspectives and experiences, enriching the investment appraisal process and decision-making, with studies suggesting that diversity can lead to superior performance.

Conclusion: maturing paths of CVC in Brazil

This year’s survey provides a detailed snapshot of the process of evolution and maturation of Corporate Venture Capital practices in Brazil, with important indications of the paths this market has taken, including the challenges faced by the Venture Capital market as a whole.

In this context, we highlight, for example, the strategic adjustment that favors tangible and more immediate results, with an increased focus on generating substantial and sustainable value. In addition, the accountability structure, mostly aimed at senior executives such as CEOs and CIOs, emphasizes the strategic importance that CVC activities have taken on within corporations.

However, a persistent and significant challenge remains in promoting gender diversity. The male predominance and slow progress towards gender equity not only reflect a worrying disparity, but also represent a barrier to innovation and efficiency in these funds.

Want to delve even deeper into the details of how CVCs were structured in Brazil in 2023? Access the Corporate Venture Capital 2023 survey!

EloGroup is a Transformation consultancy that works from strategy to delivery with the aim of unlocking the potential of organizations and people through Technology, Management and Advanced Analytics lenses! We have expertise in Innovation and Open Innovation projects, including Corporate Venture Capital for large clients in various sectors.

Do you want to understand how your company can navigate these complex and dynamic scenarios? Talk to us!